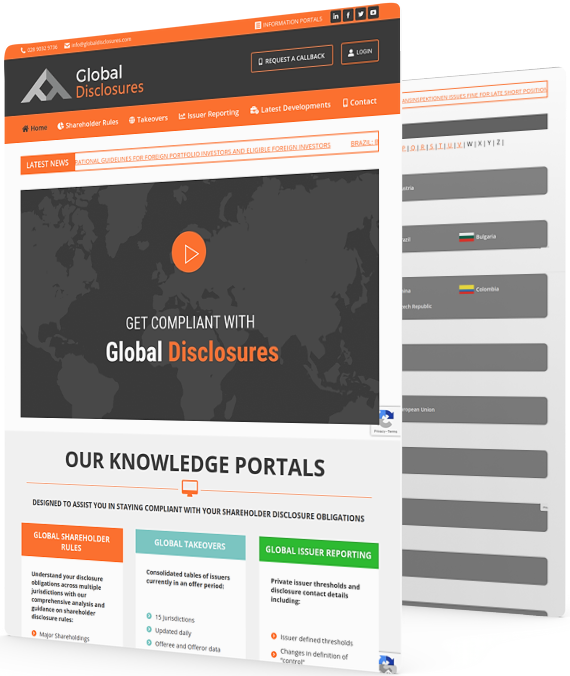

With the end of the quarter approaching, the Global Disclosure Team have summarised the key requirements of 13F Reporting.

1. Who Must File a Form 13F

Institutional investment managers that use the United States mail in the course of their business and that exercise investment discretion over USD100 million or more in Section 13(f) securities must file a Form 13.

An institutional investment manager is an entity that either invests in, or buys and sells, securities for its own account, or a natural or legal entity exercising investment discretion over the account of any other natural person or entity. Institutional investment managers can include investment advisers, banks, insurance companies, broker-dealers, pension funds, and corporations. A trustee will also be considered an institutional investment manager. However, the SEC has confirmed a natural person who exercises investment discretion over his or her own account will not be considered an institutional investment manager.

Institutional investment managers eligible to submit a form 13(f), which utilise sub-adviser(s) are required to consider their sub-advisory agreements to determine responsibility or Form 13Ffilings. A13f notice indicating that other reporting managers are required to report holdings on their behalf may need to be submitted.

2. What Securities to Report on Form 13F

Section 13(f) securities are equity securities of a class described in Section 13(d)(1) of the Securities and Exchange Act. Generally, the list includes exchange-traded (e.g., NYSE, AMEX, NASDAQ), equity options and warrants, shares of closed-end investment companies, and certain convertible debt securities. Shares of open-end investment companies (i.e., mutual funds) are not to be included on Form 13F. Shares of exchange-traded funds (“ETFs”), however, are on the Official List and are required to be included in the 13F report.

Why not request our Full Briefing Paper on 13F which includes a summary of which securities to include or exclude from the report?The current list of 13(f) securities can be found by following the below link:

https://www.sec.gov/divisions/investment/13flists.htm

3. When to File Form 13F

Form 13F must be filed no later than 45 days after the end of the March, June, September, and December quarters. If the filing deadline falls on a weekend or a holiday, then your filing is due on the next business day. (Tip: The filing deadlines are Eastern time. Managers in other time zones should note that filings submitted after 5:30 p.m. Eastern time will receive a filing date of the next business day.)

Initial Filing for first-time filers: When holdings have reached the threshold of USD100 million in 13(f) securities as of the last trading day of any month during a calendar year for the first time, an initial Form 13F report for the December quarter of that year (within 45 days after the end of the quarter) is required to be submitted. You will then need to submit filings for the 3 subsequent quarters (March, June, and September) of the following calendar year, even if the market value of your Section 13(f) securities falls below USD100 million.

4. The Form

Form 13F is a single EDGAR document with 3 parts:

- Cover Page

- Summary Page; and

- Information Table(12 Column XML report as below which is attached as a separate document)

5. Filing a form 13F

You can submit either of:

- A full XML which includes the Cover page, Summary page and Information Table; or

- an XML for the Information Table only, in which case the content for the Cover page and Summary page gets manually entered into EDGAR.

Where you do not have an automated solution, there is a relatively simple process to convert excels into the required XML format.

The Form must be filed electronically using the SEC’s EDGAR system. To file through EDGAR, you will need a Form ID, the EDGAR Filer Manual, and EDGARLink software, all of which are available through the SEC’s website.

The filer needs a Central Index Key (CIK) and CIK Confirmation Code(CCC) to submit documents to the EDGAR system and provide access to online tools and secure SEC websites. These SEC EDGAR Filer Access Codes are created by the SEC and provided when a company or individual registers with the SEC as an EDGAR filer. Filer codes consist of five unique sets of numbers; four provided by the SEC and, one created by the registrant.